Mortgage borrowing calculator with deposit

The Money Advice Service reckons borrowing 175000 at 3 interest over 35 years costs. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

Top 20 Mortgage Calculator Tools Startup Stash

To talk to one of our team at ANZ please call 0800 269 4663 or for more information about ANZs financial advice service or to view our financial advice.

. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend to you. Change the deposit you can provide or the amount you want to borrow to see how that affects your result. The Early-2017 Guide to Buying a Home March 10 2017.

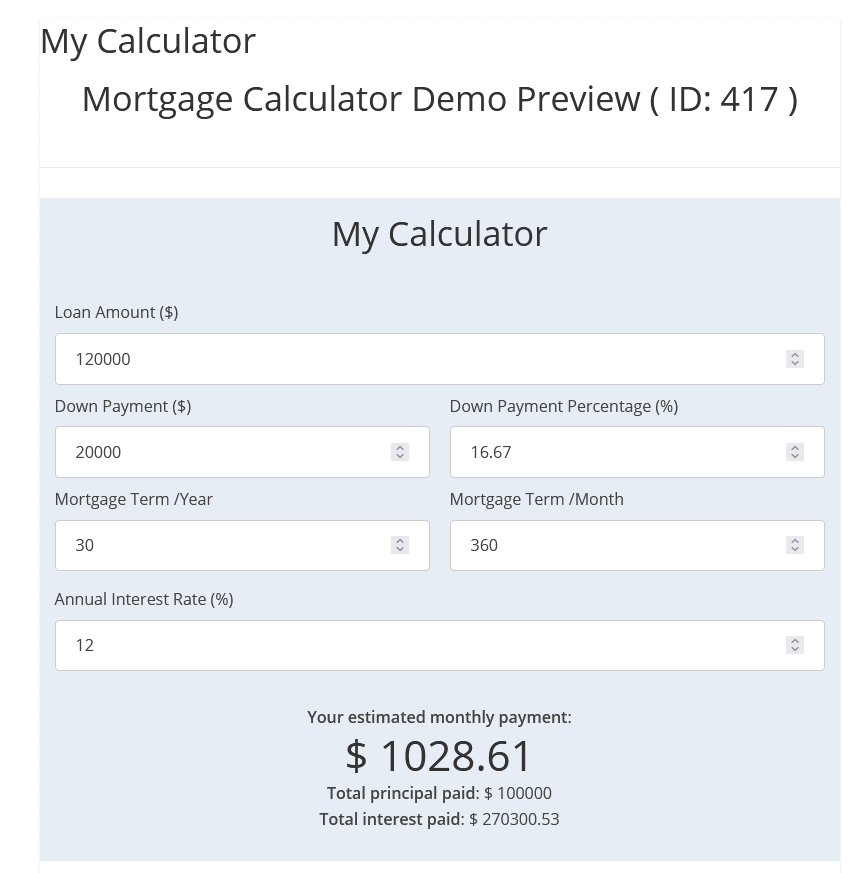

Deposit calculator Mortgage calculator How much can you bid. Second mortgages come in two main forms home equity loans and home equity lines of credit. Our mortgage repayment calculator shows how much your monthly mortgage payments will be based on the amount youre borrowing fees term and interest rate.

Loan to value of. They typically request at least 5 deposit based on the value of the property. The Loan term is the period of time during which a loan must be repaid.

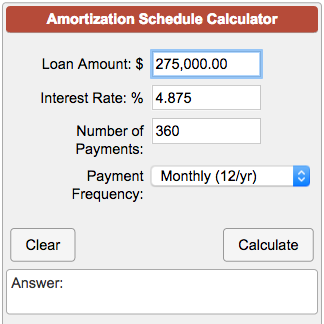

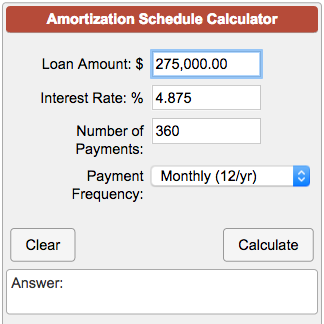

For example a 30-year fixed-rate loan has a term of 30 years. In most cases you will need a minimum of a 5 deposit to secure a mortgage meaning youll need a 95 mortgage loan. The loan amount P or principal which is the home-purchase price plus any other charges minus the down payment.

How to buy a house with 0 down. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. First-time home buyer How to use this mortgage calculator.

If you have a mortgage with a 30-year loan term and you opt to go interest-only for 5 years then you need to have the income to pay down the principal over a 25-year period. Lenders Mortgage Insurance is an insurance designed to cover Westpac thats put into place when you take out a home loan and your deposit is less than 20 although it can apply in other circumstances too. Reverse mortgage interest rates do tend to be higher than for regular home loans.

Use a mortgage borrowing calculator. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Meanwhile some lenders may offer first-time buyers a 100 mortgage with a 0 deposit.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. Reverse mortgage interest rates. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the.

If you choose to use lenders mortgage insurance to increase your. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. The impact of a reverse mortgage on your home equity as the years progress.

Use our free mortgage calculator to estimate your monthly mortgage payments. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Existing customer PPI information.

Just enter the loan amount term length interest rate and any repayments to get a complete breakdown of where your mortgage payments are going. How much can I borrow. Help to Buy calculator.

Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real cost. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real cost of. Your rough mortgage borrowing estimate.

A mortgage in itself is not a debt it is the lenders security for a debt. Get a rough idea of what a lender might offer you. Banking Products and Services provided by First Horizon Bank.

This mortgage payment calculator will help you. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. This calculator is for information purposes only and does not provide financial advice.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. May be purchased from any agent or company and the customers choice will not affect current or future credit decisions.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Mortgage fees and charges. Before the banks approve your interest-only mortgage they will test if you have the income right now to afford the higher payments once the interest-only period ends.

Reverse mortgage rates for seniors. The annual interest rate r on the loan but beware that this is not necessarily the APR because the mortgage is paid monthly not annually and that creates a slight difference between the APR and the interest rate. We recommend seeking financial advice about your situation and goals before getting a financial product.

Switching to Lloyds Bank. Insurance Products and Annuities. The InfoChoice Principal and Interest Calculator makes it easy to see how much of your mortgage repayment is going towards principal and interest every month.

If a house is valued at 180000 a lender would expect a 9000 deposit. Account for interest rates and break down payments in an easy to use amortization schedule. We calculate this based on a simple income multiple but in reality its much more complex.

100k deposit 480k bank valuation 021 x100 for a percentage 21 deposit. This is a handy step to take before you contact your mortgage broker so that you can see the effect different interest rates and loan periods will have on the amount of money you can borrow the total interest you pay and your estimated. Deposit calculator Mortgage calculator How much can you bid.

A mortgage calculator for professionals that can solve for payments principal term or rate. Its to protect Westpac should something happen leaving you unable to pay back your loan in full. This makes it important to use our reverse mortgage calculator to understand the impact on your home equity over time.

The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be. To qualify for a mortgage you need a deposit of at least 5 of the propertys value. Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer.

In this example the lender would be willing to offer a loan amount of 171000. Second mortgage types Lump sum. Find out how much you can borrow with our mortgage calculator that scans over 20000 mortgages from 90 lenders to find real products you could be eligible for.

The number of years t you have to.

Free Mortgage Calculator Free Financial Tools Transunion

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Top 20 Mortgage Calculator Tools Startup Stash

Discount Points Calculator How To Calculate Mortgage Points

Mortgage Calculator How Much Monthly Payments Will Cost

Amortization Schedule Calculator

Free Mortgage Calculator Free Financial Tools Transunion

Top 20 Mortgage Calculator Tools Startup Stash

Top 20 Mortgage Calculator Tools Startup Stash

Top 20 Mortgage Calculator Tools Startup Stash

Mortgage Calculator Money

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

How To Calculate Mortgage On Your Site Using Mortgage Calculator Plugin

Mortgage Calculator How Much Monthly Payments Will Cost

Top 20 Mortgage Calculator Tools Startup Stash

Balloon Loan Calculator Single Or Multiple Extra Payments

Are You Ready To Take Control Of Your Financial Life We Re Here To Help Financial Change Is All Interest Calculator Credit Card Interest Loan Interest Rates